Energy & Chemicals

Eastern Ohio sits atop of the Utica Shale and adjacent to the Marcellus Shale formations, which together now account for 43% of U.S. shale gas production. These abundant hydrocarbons combined with Ohio’s transparent, equitable and streamlined regulatory environment have yielded over $90 billion in upstream, midstream and downstream investment in the shale energy and petrochemical sectors since 2011.

John D. Rockefeller started Standard Oil in Ohio. Shale has returned Ohio into the PetChem spotlight. Eastern Ohio sits atop of the Utica Shale and adjacent to the Marcellus Shale formations, which together now account for 43% of U.S. shale gas production. These abundant hydrocarbons combined with Ohio’s transparent, equitable and streamlined regulatory environment have yielded over $90 billion in upstream, midstream and downstream investment in the shale energy and petrochemical sectors since 2011.

The Utica and Marcellus shales also produce oil and prolific amounts of natural gas liquids, which are the feedstocks of many petrochemicals and plastics. One of the primary NGLs that is being produced in mass quantities is ethane, the major building block for polyethylene, which Is the foundation for making most plastic.

Due to shale gas growth in recent years, the OhioSE region has over 3,350 permitted wells with 2,600 drilled and 2,500 producing.

Energy + Petchem Stats

Why Ohio Southeast

There are 3,350 permitted horizontal Utica Shale wells in Eastern Ohio

Southeast Ohio is over top of Utica Shale and next door to the Marcellus Shale

We have an abundance of raw materials far below Gulf of Mexico prices

Ohio was ranked 5th Best Regulatory Environment by Forbes Magazine

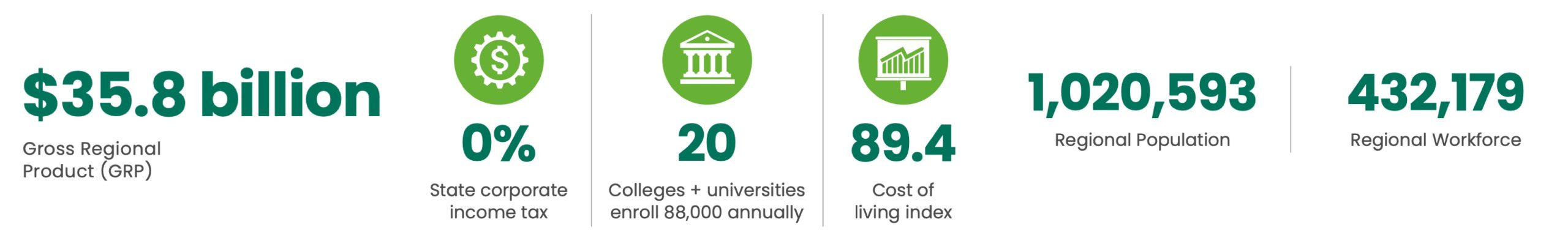

NET PRESENT VALUE IN 2020, SHALE CRESCENT USA VS GULF COAST

Key Regional Assets

We offer great market access by highway, rail & Ohio River barge. A study by IHS Markit Insight found polyethylene production in the Ohio-PennsylvaniaWest Virginia region could result in 4X better earnings based on cheaper feedstock and lower freight costs of the end product since 70% percent of the U.S. market for polyethylene is within a day’s drive of the tri-state area.

Our taxes, wage rates, and utility costs are below national and regional averages. Ohio taxes are some of the most favorable in the USA for manufacturing or any business selling goods and services outside of Ohio.

In 2021, the Tax Foundation ranked Ohio 4th most favorable for capital-intensive manufacturers for mature firms and 3rd for capital-intensive manufacturing for new firms.

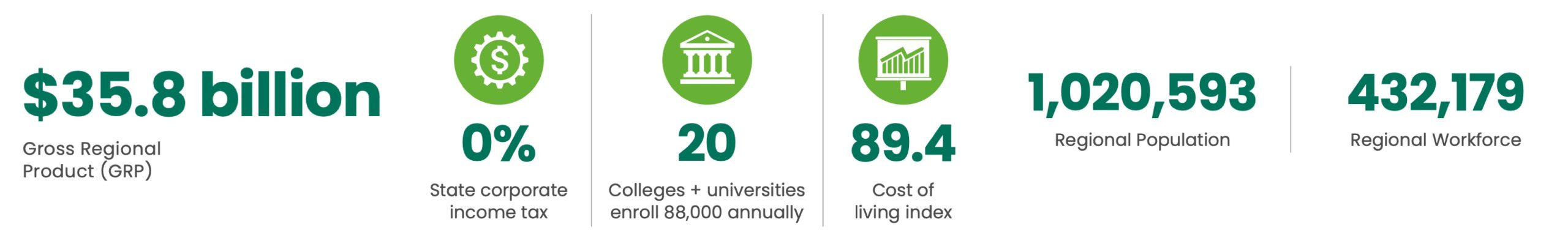

Fast Facts

-

Ohio is #1 in production of engines

-

Ohio is #2 in transmission products

-

Ohio is #2 in car production

-

Ohio is #1 supplier state to Boeing and Airbus

-

Taxes, wage rates, and utility costs below national and regional averages

Regional Snapshot

I Can Help

Katy Farber, OhioSE VP, directly oversees the OhioSE-Jobs Ohio project management efforts. She was an OhioSE Project Manager for five years, working with eight of the southern-most counties in the region prior to her vice presidency promotion.

Contact KatySoutheastern Ohio is the Choice

“A petrochemical facility in the Shale Crescent USA (Utica & Marcellus shale regions) generates a net present value four times higher than the Gulf Coast.”

Jerry James President, Artex Oil Company