The Cost Advantage

Get the numbers that drive smart business decisions—cost of living, wages, energy, real estate, operating expenses, and corporate taxes.

It costs less to do business in Southeastern Ohio.

Here, lower wages and property costs keep your overhead low, while your workforce benefits from an affordable lifestyle without sacrificing quality. It’s a win-win for your bottom line and your team.

Operating Costs

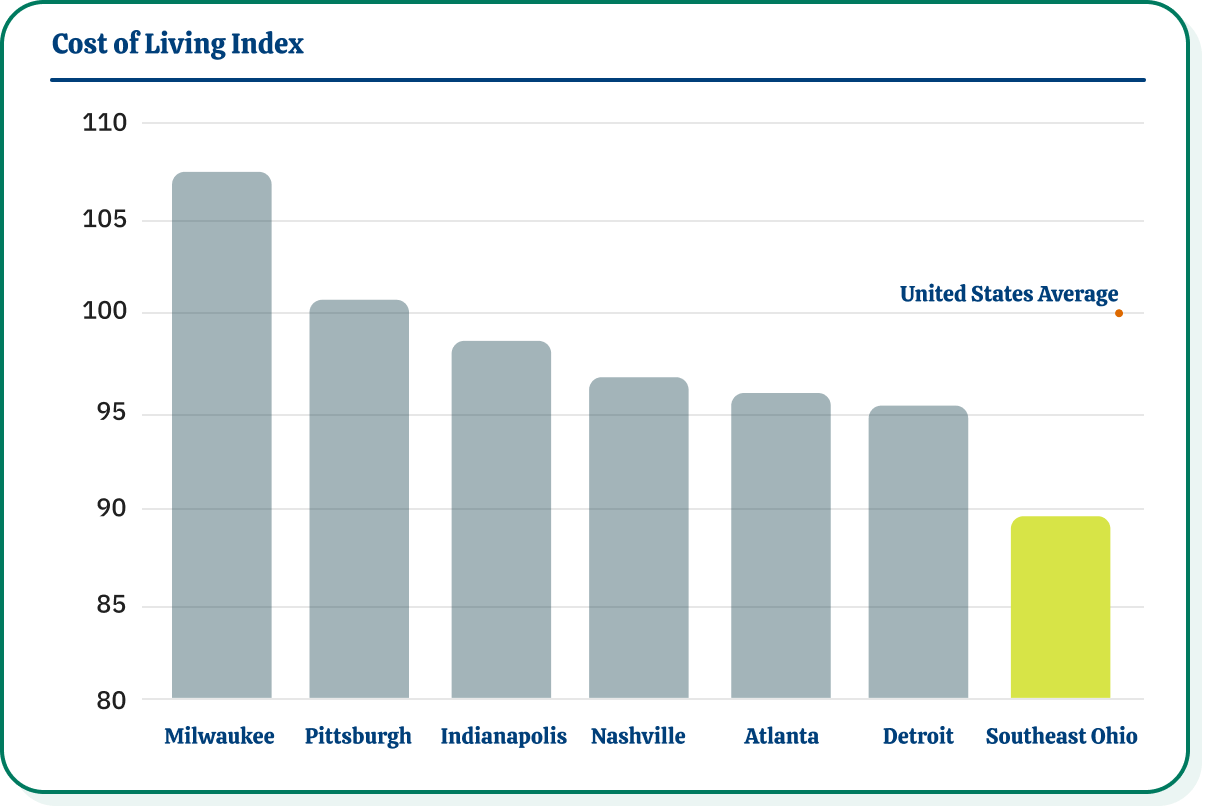

The math is pretty simple. It costs less to live here, and it costs less to do business here. For a resident, the cost of living is below national and regional indexes.

Wages

Below average payroll costs help keep options effecient.

Corporate State and Local Taxes

Ohio has no taxes on corporate profits, inventory, tangible personal property, R&D investments, and products sold to customers outside Ohio.

Lower Cost of Living

For a business, a lower cost of living, means lower wages. Ohio taxes are some of the most favorable in the USA for manufacturing or any business selling goods and services outside of Ohio.

Affordable and Profitable Energy

The Ohio Southeast region is home to an abundance of low cost natural gas and natural gas liquids for energy and chemical feedstocks. \n\nThe Marcellus & Utica Shales overlap in Pennsylvania, eastern Ohio, and West Virginia and combine to create the largest gas producing formation in the USA. By 2030, Appalachia will supply about 40% of the North American Market. Production levels are expected to be 55 Bcf/d by that time. Sources: McKinsey Energy Insights & U.S. Energy Information Administration

A study by IHS Insight:

A study by IHS Insight found that polyethylene production in the Ohio-Pennsylvania-West Virginia region could yield four times higher earnings. This is due to cheaper feedstock and lower freight costs for the final product, because 70% of the U.S. market for polyethylene is within a day’s drive of this tri-state area. \nLearn more at Shale Crescent USA.

Real Estate Costs

Real Estate Costs

Property costs in Southeastern Ohio are among the most competitive for manufacturing and industrial operations nationwide. Distribution and warehousing and manufacturing rent is 49% cheaper in the OhioSE region than the national average, and lower than costs in the Midwest and Columbus Metro Area.